cartier sales tax All prices shown or quoted by the applicable Sales Channels are in U.S. Dollars unless other. $5,000.00

0 · cartier terms of sale

1 · cartier sale rules

2 · cartier merchandise refund

3 · cartier conditions of sale

4 · cartier condition of sale form

5 · cartier condition of sale 2022

6 · cartier canada sale

7 · cartier bags for sale

Large model, hand-wound mechanical movement, rose gold, diamonds, leather. $24,800. Showing 24 of 41 items. Complimentary Delivery. EASY RETURN OR EXCHANGE. .

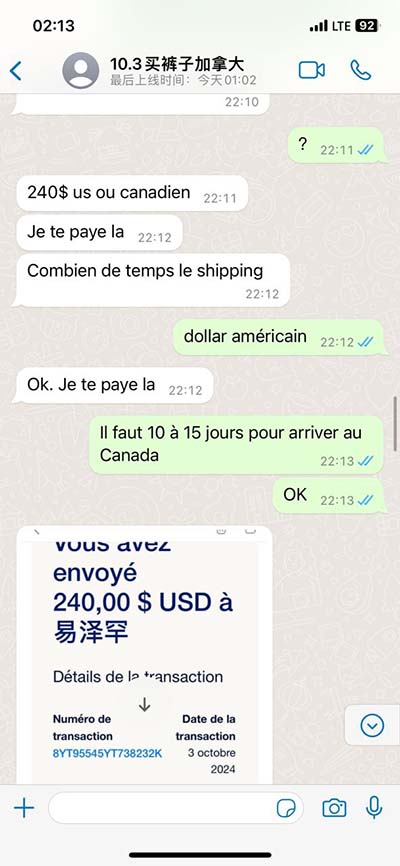

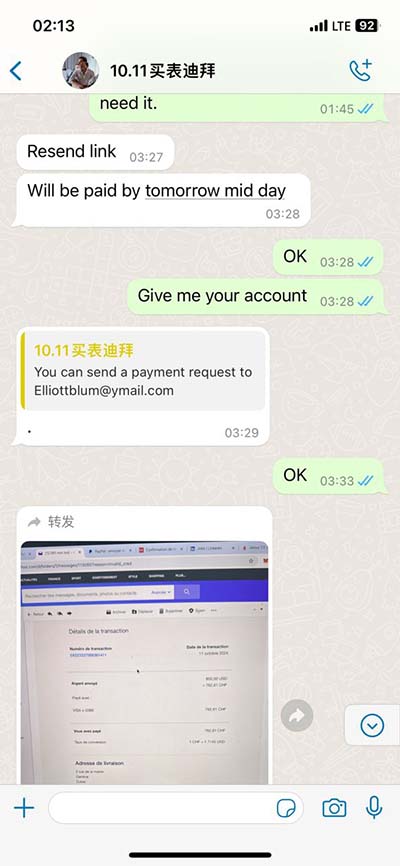

Sales and use taxes will vary based on the location to which products are being shipped. Delivery costs and estimated sales and use taxes are not stated on the product pages but will be added to the product price, if applicable, after you have chosen your delivery location and options.

All prices shown or quoted by the applicable Sales Channels are in U.S. Dollars unless other.All prices shown or quoted by the applicable Sales Channels are in U.S. Dollars unless otherwise stated and exclude sales tax, shipping costs and other taxes unless otherwise stated. Sales, .Sales, use or other taxes will vary based on the location to which products are being shipped. Shipping costs, if any, are described in the Shipping Policy below or on the Sales Channels.

All prices shown on the product pages of the Platforms or quoted by the Client Relations Center include sales taxes/VAT but exclude shipping costs and other taxes unless otherwise stated. Does anyone have any experience buying one from the official Cartier site or any other places? Wondering if there is a price difference. Does the Cartier site charge sales tax? Yes, more or less exactly. You do not have to pay "sales tax" but pay "use tax" instead which essentially is the same.I've been reading about the process to get a refund on the tax collected by the merchant (Cartier) at time of sale. I understand I'll need to bring my passport to the store and maintain the .

Duty free prices for Cartier items are generally lower compared to retail prices due to the tax exemptions and duty waivers provided in these specific shopping locations. Last year I bought a VCA bracelet from a boutique in NJ and had it shipped to me it was Tax free . I DO have both VCA and Cartier stores in my state. If I call Short Hills Cartier . 2 important things - Sales tax in PA is 6% - definitely not 3%! Also, the red card is no longer being accepted. So you have to apply in person at a Cartier boutique for their new .

New York has state sales tax of 4%, and allows local governments to collect a local option sales tax of up to 4.875%.There are a total of 642 local tax jurisdictions across the state, collecting an average local tax of 4.253%. Click . A three-year city investigation showed that two-thirds of all Cartier sales went untaxed and that no taxes were paid on more than 90 percent of jewelry worth ,000 and more. The combined city .These Conditions of Sale apply to any sales of Cartier products or services that you may order from our Selling Entity . All prices shown on the product pages of the Platforms or quoted by the Client Relations Center include sales taxes/VAT but exclude shipping costs and other taxes unless otherwise stated.Switzerland is 7.7% VAT with full refund, and an easy process at the airport to claim it. Purchased a Santos from the Cartier store in Zurich and the sales associate had instructions for the refund clearly laid out. Saved about ,000 vs what the same watch would cost me in the states with sales tax (11% sales tax where I live.)

If I call Short Hills Cartier will they ship and will it be Tax free also? TIA! C. citysurfer1 Member. Apr 12, 2015 47 105. Aug 30, 2017 #2 Aug 30, 2017 #2 no if they have one in ur state they will charge you tax. u need to ship it somewhere that doesn't have a cartier . rhm. O.G. May 3, 2014 744

There is no PST For orders shipped to New Brunswick, Newfoundland and Labrador and Nova Scotia - 13% HST (Harmonized Sales Tax) will be applied For those clients with tax exempt status, please contact Toronto store at 800 265 1251 or 416 921 3900, in person or via [email protected] Conditions of Sale apply to any sales of Cartier products or services that you may order from our Selling Entity (as defined below), using this website and any associated mobile or digital applications that refer to these Conditions of Sale (together, the “Platforms”) or by telephone via our client relations center (the “Client Relations Center”). You will not receive a 20% VAT refund. Cartier will process all the detaxe forms and you will submit them at airport upon your departure. The various fees associated with the refund will result in a 12% refund.

cartier terms of sale

Or, use the alternate formula: total = price × (1 + tax rate) = 1,500.00 × (1 + 0.0725) = 1,500.00 × 1.0725 = 1,608.75 Shortcut, when sales tax is 7.25% multiply the list price by 1.0725 to calculate the final total that will include tax. No local sales tax, if you buy online often sites (like Ebay) charge sales tax. The tank is an older model style, you should be able to get good discount, well over 10%. Reactions: Jean1888. Save Share . BNIB but with the dealer warranty rather than Cartier card, but I figured it would only go back to Cartier under that anyway, and how often .

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Usually, the vendor collects the sales tax from the consumer as the consumer makes a purchase. In most countries, the sales tax is called value-added tax (VAT) or goods and services tax (GST), which is a different form of consumption tax.

1.1. Global-e has agreement with RLG Europe B.V., Amsterdam (NL), Swiss Branch, Villars-sur-Glâne (“Cartier”), to make Cartier’s merchandise available to you for purchase from, and delivered by, Global-e ("Merchandise").This allows you to buy such Merchandise from Global-e in your local currency and at a price that includes any applicable sales taxes (such as VAT), .The sales and use tax rate in a specific California location has three parts: the state tax rate, the local tax rate, and any district tax rate that may be in effect. State sales and use taxes provide revenue to the state's General Fund, to cities and counties through specific state fund allocations, and to other local jurisdictions.These Conditions of Sale apply to any sales of Cartier products or services that you may order from Cartier Limited by e-mail or phone at a distance or at an event outside of the Cartier boutique via the relevant retail boutique of Cartier (together the Cartier Boutique”).. Cartier Limited has its registered offices at 175-177 New Bond Street, London, W1S 4RN (Cartier and .

California City & County Sales & Use Tax Rates (effective October 1, 2024) Español. These rates may be outdated. For a list of your current and historical rates, go to the California City & County Sales & Use Tax Rates webpage. Look up the current sales and use tax rate by addressCartier Creations purchased through the Cartier e-Boutique or Client Relation Center may be returned or exchanged in accordance with our Conditions of Sale. . Shipping fees are based on the value of your order including sales tax: Standard delivery* Order value Cost of delivery All orders Complimentary. Express delivery* Order value Cost of .Cartier Discussions, News, and Sharing of Recent Purchases Members Online • rozyozy. ADMIN MOD Sales Tax . Hi all! I’m looking to purchase the Juste Un Clou choker for ,200. Is there anyway to get around paying the sales tax? TIA Share Add .

Consider warranty and after-sales service: While duty free purchases are often covered by Cartier’s warranty, it is important to clarify the terms and conditions, as well as the availability of after-sales services, before making a purchase. . and it’s also a great place to find Cartier duty-free products. With its tax-free policies and a .These Conditions of Sale apply to any sales of Cartier products or services that you may order from our Selling Entity (as defined below), using this website and any associated mobile or digital applications that refer to these Conditions of Sale (together, the “Platforms”) or by telephone via our client relations center (the “Client Relations Center”). From VAT tax refund and customs duty exemption to the fluctuating prices of Cartier products, there's a lot of nuance that determines whether or not Cartier products are cheaper here. This 2024 buyer's guide will explain the best times to buy, average savings, and explains the VAT refund system for luxury purchases in Paris.All prices shown on the product pages of the Platforms or quoted by the Client Relations Center include sales taxes/VAT but exclude shipping costs and other taxes unless otherwise stated. . is evidence of delivery and fulfilment of the sales contract by Cartier and transfer of responsibility to the recipient in the same way as if the product .

Shop for pre-owned Cartier jewelry up to 90% off. Fully authenticated by our team of experts, only at The RealReal. Your Closest Locations Close Your Closest Locations menu . Become a first look member. For a month, get 24-hour advance access to sales and special invitations to monthly promotions. Become a. First Look Member. For a .

cartier sale rules

dior joaillerie paris

In 2023, the Cartier brand was valued at approximately 12.5 billion U.S. dollars. In comparison, the brand's valuation was 9.8 billion U.S. dollars in 2018. . 1 All prices do not include sales .

Hi folks! I live in California but will be visiting my friend in Oregon soon. Thinking about buying the pave love bracelet for a personal milestone (ten years anniversary and a baby finally!😀) so I was wondering if you know if Cartier can ship items to .I live in Ontario, Canada. Buying from them would mean I have to pay 13% of sale tax and insane import duties. Here are a list of countries/regions that I heard have great deals on Cartier watches: Hong Kong: A lot of options, often with 5-25% discounts. Haikou City, Hainan Province, China: Tax-free luxury goods stores.Sales & Tax Overview for 24 Cartier Drive, Franklin Park. View detailed information on past sales, title documents and property taxes, including the assessed market value, in their dedicated tabs. Sale date: 12/20/2012: Sale price: 0: Current property tax: ,441:Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Florida's general state sales tax rate is 6% with the following exceptions: Retail sales of new mobile homes - 3%; Amusement machine receipts - 4%; Rental, lease, or license of commercial real property - 2%; Electricity - 6.95% .

colonia emperatriz dolce gabbana

cartier merchandise refund

18K solid white gold. 18K solid yellow gold. 18K solid yellow gold or 14K gold‑plated with SS case back. . Details Seamaster Omega - ST 166.0068-1 Details. . Gold Watches; .

cartier sales tax|cartier bags for sale