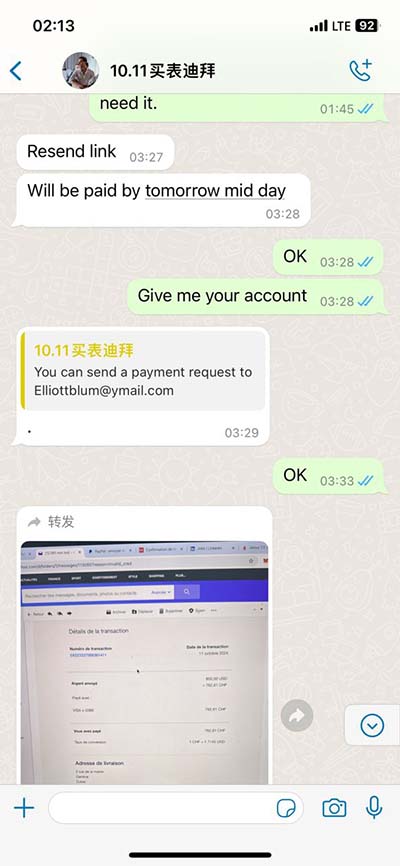

fake credit card dispute clothing purchased If your credit card was used fraudulently, you have the right to file a dispute (called a chargeback) with your credit card issuer. Some consumers, however, take advantage of this . This page will provide leveling tips and recommendations to maximize efficiency while leveling from 70 to 80 with the new Final Fantasy XIV: Endwalker classes Reaper and Sage. However, please note these tips will also be useful for any player looking to level from 70 - 80 with any class.

0 · legitimate credit card disputes

1 · how to dispute credit card charges

2 · fraudulent credit card dispute

3 · false credit card claim

4 · credit card disputes

5 · credit card dispute settlement

6 · credit card dispute investigation

7 · credit card dispute cases examples

All Endwalker Dungeons for FFXIV. Last updated on Aug 11, 2022 at 11:00 by Lyra 1 comment. New dungeons will be introduced in the Endwalker expansion. This page serves as a hub to all the leveling and endgame dungeons coming in Endwalker. This page contains heavy spoilers for the main scenario, so be wary. All Endwalker Guides.

You can dispute credit card charges with your issuer for three reasons under the Fair Credit Billing Act: Someone else used your card without permission. Say a. fraudster. . Use a credit card for online purchases, if possible. Credit cards offer the most protection against fraud compared to other types of payments including the right to dispute . The Fair Credit Billing Act (FCBA) allows credit card users to dispute charges that involve billing errors and fraud. It also covers services and products not provided as agreed . If your credit card was used fraudulently, you have the right to file a dispute (called a chargeback) with your credit card issuer. Some consumers, however, take advantage of this .

legitimate credit card disputes

how to dispute credit card charges

If you purchased the item through a “buy now, pay later” service that is not offered by your credit card, your rights are different. If you’re having trouble with a credit card, you can . What do you do if an unauthorized charge appears on your credit card statement? Or, if you made a purchase, but the seller didn’t live up to their end of the bargain? In either .

If you never got your order and the charge appears on your credit card statement, you can dispute it as a billing error. File a dispute online or by phone with your credit card company. To protect .

Credit card disputes may occur when you disagree with the accuracy of a charge that appears on your statement. They typically fall into one of three categories: fraudulent .

According to the Fair Credit Billing Act, consumers are allowed to dispute a credit card charge within 60 days of it posting to their account. In some cases, even if you willingly paid for something, you can file a dispute. You can dispute credit card charges with your issuer for three reasons under the Fair Credit Billing Act: Someone else used your card without permission. Say a. fraudster. charged a. But what happens when consumers start abusing the system by filing false chargeback claims or credit card disputes? In this article, we break down the dispute process, and discuss the impact of false credit card dispute claims made by cardholders.

Use a credit card for online purchases, if possible. Credit cards offer the most protection against fraud compared to other types of payments including the right to dispute charges if there are problems with your purchase. Always .

The Fair Credit Billing Act (FCBA) allows credit card users to dispute charges that involve billing errors and fraud. It also covers services and products not provided as agreed upon. Understanding the types of problems covered by the FCBA is an important part of correctly using a . If your credit card was used fraudulently, you have the right to file a dispute (called a chargeback) with your credit card issuer. Some consumers, however, take advantage of this safeguard by filing false chargeback claims. If you purchased the item through a “buy now, pay later” service that is not offered by your credit card, your rights are different. If you’re having trouble with a credit card, you can submit a complaint to the CFPB online or by calling (855) 411-CFPB (2372). What do you do if an unauthorized charge appears on your credit card statement? Or, if you made a purchase, but the seller didn’t live up to their end of the bargain? In either case, you’re entitled to dispute the charge and get your money back.

If you never got your order and the charge appears on your credit card statement, you can dispute it as a billing error. File a dispute online or by phone with your credit card company. To protect any rights you may have, also send a letter to the address listed for billing disputes or errors. Credit card disputes may occur when you disagree with the accuracy of a charge that appears on your statement. They typically fall into one of three categories: fraudulent charges, billing errors, or a complaint about the quality of goods or . According to the Fair Credit Billing Act, consumers are allowed to dispute a credit card charge within 60 days of it posting to their account. In some cases, even if you willingly paid for something, you can file a dispute.

fraudulent credit card dispute

You can dispute credit card charges with your issuer for three reasons under the Fair Credit Billing Act: Someone else used your card without permission. Say a. fraudster. charged a.

But what happens when consumers start abusing the system by filing false chargeback claims or credit card disputes? In this article, we break down the dispute process, and discuss the impact of false credit card dispute claims made by cardholders. Use a credit card for online purchases, if possible. Credit cards offer the most protection against fraud compared to other types of payments including the right to dispute charges if there are problems with your purchase. Always .

The Fair Credit Billing Act (FCBA) allows credit card users to dispute charges that involve billing errors and fraud. It also covers services and products not provided as agreed upon. Understanding the types of problems covered by the FCBA is an important part of correctly using a .

If your credit card was used fraudulently, you have the right to file a dispute (called a chargeback) with your credit card issuer. Some consumers, however, take advantage of this safeguard by filing false chargeback claims. If you purchased the item through a “buy now, pay later” service that is not offered by your credit card, your rights are different. If you’re having trouble with a credit card, you can submit a complaint to the CFPB online or by calling (855) 411-CFPB (2372). What do you do if an unauthorized charge appears on your credit card statement? Or, if you made a purchase, but the seller didn’t live up to their end of the bargain? In either case, you’re entitled to dispute the charge and get your money back.If you never got your order and the charge appears on your credit card statement, you can dispute it as a billing error. File a dispute online or by phone with your credit card company. To protect any rights you may have, also send a letter to the address listed for billing disputes or errors.

Credit card disputes may occur when you disagree with the accuracy of a charge that appears on your statement. They typically fall into one of three categories: fraudulent charges, billing errors, or a complaint about the quality of goods or .

Dungeons are instanced areas teeming with enemies and bosses, fought by a party of 4 players (1 tank, 1 healer, and 2 DPS). Each instance of a dungeon is separate from others and is exclusive to a specific party. Dungeons need to be unlocked through quests (many are unlocked as part of the main story).

fake credit card dispute clothing purchased|how to dispute credit card charges